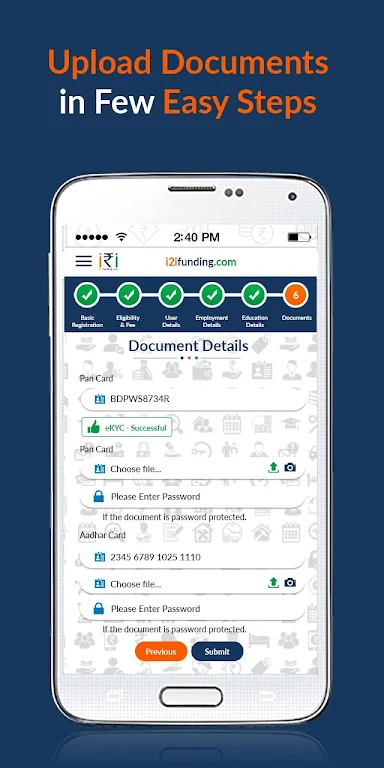

Looking for a new and better way to get a personal loan in India? Look no further than i2ifunding Personal Loan App, the innovative Peer to Peer lending platform that is revolutionizing the loan industry. With the i2iFunding Borrower's App, you can easily apply for an unsecured personal loan at affordable interest rates. Whether you need funds for a wedding, education, or any other personal expense, i2iFunding has you covered. The app offers flexible loan amounts ranging from Rs. 1,000 to Rs. 5,00,000 and flexible loan tenures from 3 to 12 months. Plus, there's no collateral or security required! Say goodbye to prepayment penalties and hello to financial freedom with i2iFunding. Join the thousands of satisfied borrowers who have already experienced the convenience and reliability of i2iFunding. Download the app now and take control of your finances today.

Features of i2ifunding Personal Loan App:

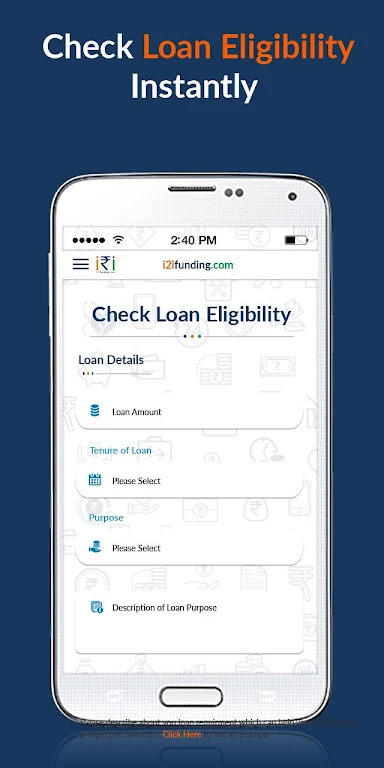

* Loan amount flexibility: i2iFunding offers personal loans allow borrowers to choose the loan amount that suits their needs.

* Flexible loan tenure: Borrowers can select their own EMI tenure, ranging from 3 months to 12 months. This feature provides borrowers with the flexibility to repay the loan according to their financial situation.

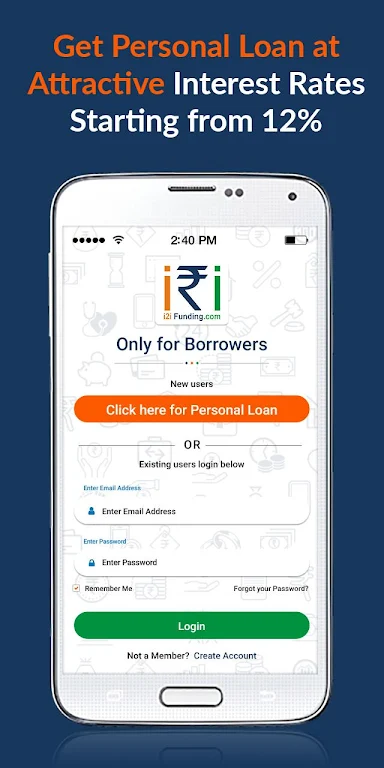

* Competitive interest rates: i2iFunding offers interest rates starting from 12% per year up to 36% per year. Borrowers can benefit from affordable interest rates, making their loan repayment more manageable.

* Minimal processing fee: The processing fee for i2iFunding personal loans ranges from 2% to 10% of the loan amount. This ensures that borrowers are not burdened with excessive charges during the loan application process.

Tips for Users:

* Compare loan amounts: Before applying for a personal loan on i2iFunding, carefully assess your financial needs and determine the loan amount required. Compare the available loan options to find the most suitable one for you.

* Consider loan tenure: Evaluate your repayment capabilities and choose a loan tenure that aligns with your financial situation. Selecting a longer tenure may result in lower EMIs but higher interest payments over time.

* Plan for processing fees: Take into account the processing fees associated with the personal loan. It is important to factor in these charges when deciding on the loan amount to ensure that it fits within your budget.

Conclusion:

i2iFunding's Personal Loan App offers a range of features that make it a desirable option for borrowers in India. With flexible loan amounts and tenures, competitive interest rates, and minimal processing fees, i2iFunding ensures convenience and affordability. By following the playing tips provided, borrowers can make informed decisions and maximize the benefits of i2iFunding's P2P lending platform. Whether for emergency expenses or fulfilling personal goals, the i2iFunding Personal Loan App is an excellent choice for accessing quick and hassle-free loans. Visit i2iFunding's website or download the app now to experience the benefits firsthand.